How American Tax Consultants Make IRS Filing Easier for Individuals and Companies

Filing taxes with the IRS can feel very hard. Many people and firms find it hard to follow rules. Mistakes in forms can cause fines and stress. American tax consultants help make the whole process simple. American tax consultants guide each client step by step carefully.

These experts show clients which forms to fill out and how. They explain which income and costs must be reported. Using American tax consulting saves time and cuts stress. Many clients trust these experts to handle tax work. They also teach clients ways to stay organized.

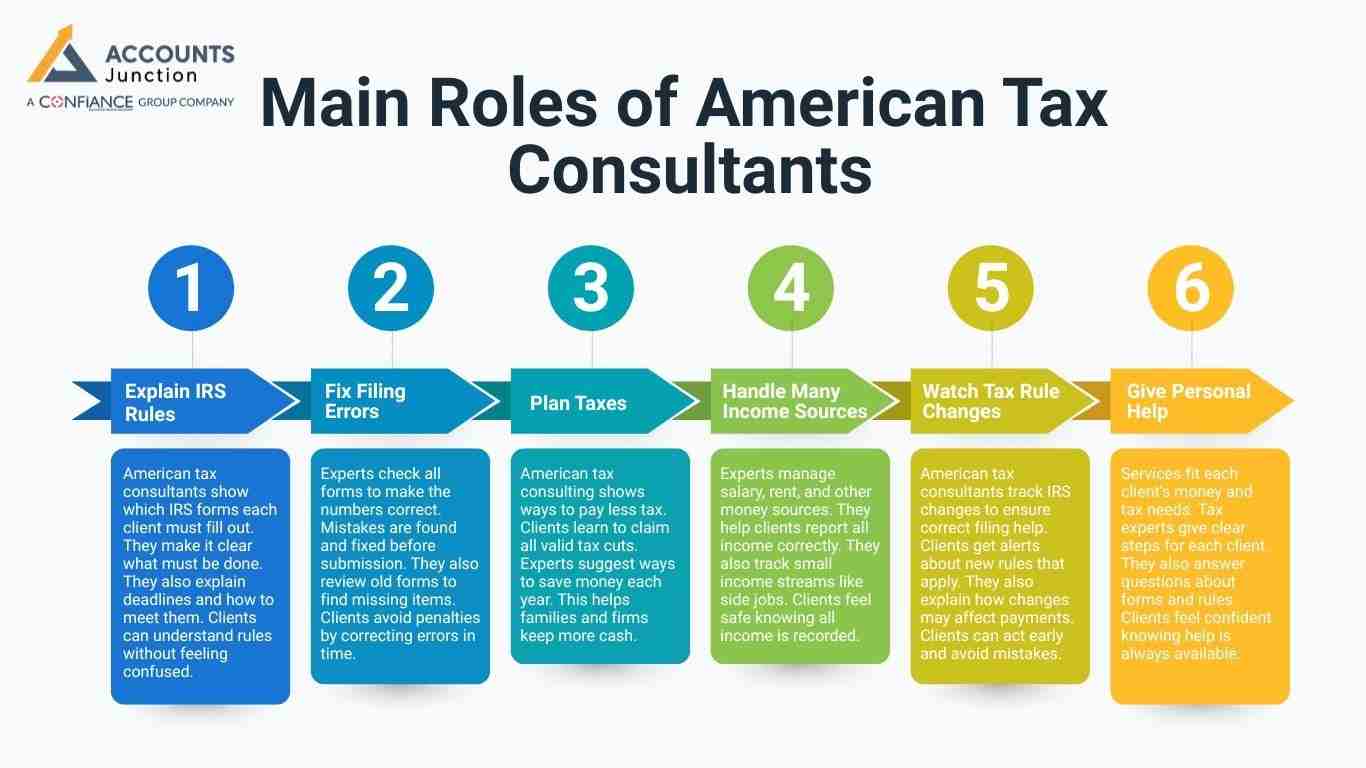

Main Roles of American Tax Consultants

-

Explain IRS Rules

American tax consultants show which IRS forms each client must fill out. They make it clear what must be done. They also explain deadlines and how to meet them. Clients can understand rules without feeling confused.

-

Fix Filing Errors

Experts check all forms to make the numbers correct. Mistakes are found and fixed before submission. They also review old forms to find missing items. Clients avoid penalties by correcting errors in time.

-

Plan Taxes

American tax consulting shows ways to pay less tax. Clients learn to claim all valid tax cuts. Experts suggest ways to save money each year. This helps families and firms keep more cash.

-

Handle Many Income Sources

Experts manage salary, rent, and other money sources. They help clients report all income correctly. They also track small income streams like side jobs. Clients feel safe knowing all income is recorded.

-

Watch Tax Rule Changes

American tax consultants track IRS changes to ensure correct filing help. Clients get alerts about new rules that apply. They also explain how changes may affect payments. Clients can act early and avoid mistakes.

-

Give Personal Help

Services fit each client’s money and tax needs. Tax experts give clear steps for each client. They also answer questions about forms and rules. Clients feel confident knowing help is always available.

IRS Filing Support for People

-

Make Forms Simple

American tax consultants break IRS forms into small, easy steps for clients. Clients can finish forms without stress or mistakes. They also show examples to follow for each form. This makes filing faster and less confusing.

-

Get Full Refunds

Experts check for all valid deductions and credits. Clients get the full refund they can claim. They also advise on tax breaks for families. This ensures no money is left unclaimed.

-

Help During Audits

Tax experts guide people if the IRS checks forms. They show what to do step by step. They also explain which papers to keep ready. Clients feel calm and prepared during audits.

-

Plan Taxes Year-Round

American tax consulting provides year-round advice for proper tax planning. Early planning stops errors and last-minute stress. They also suggest small changes to reduce yearly tax. Clients avoid big payments by planning early.

-

Update for Life Changes

Marriage, kids, or buying land changes taxes. Tax experts adjust forms to fit these changes. They also help with new deductions from major life events. Clients stay compliant and avoid extra payments.

IRS Filing Support for Companies

-

Keep Records Organized

Tax experts help firms keep clear and correct books. Well-kept books make filing much simpler. They also advise on simple ways to track costs. This reduces mistakes and saves time during filings.

-

Payroll and Tax Reporting

American tax consultants calculate business and payroll taxes accurately each month. Mistakes that bring fines are avoided. They also review reports for accuracy before submission. Clients can focus on business without tax worry.

-

Handle Multi-State Filing

Firms in many states get clear help for forms. Experts make sure all state rules are met. They also track deadlines for each state separately. Clients avoid extra penalties by filing on time.

-

Find Tax Cuts

American tax consulting finds all legal deductions for firms. Proper filing lowers tax bills. They also show ways to reduce yearly expenses legally. This helps companies save money safely.

-

Reduce Audit Risk

American tax consulting ensures firms follow rules to reduce audit risks. Correct forms and clear books help firms. They also give advice on common IRS triggers. Clients feel safe knowing audits are less likely.

-

Plan Taxes Long-Term

Experts help firms plan taxes for the year. American tax consultants help firms plan taxes to reduce stress later. They also suggest ways to adjust spending and income. Companies can forecast cash flow with expert help.

Services by American Tax Consulting

-

Check Finances

Experts look at income, rent, and other costs. This review makes a clear plan for filing. They also find areas where clients may save money. This reduces future tax burdens.

-

Prepare and Check Forms

American tax consultants fill out and check all forms for accuracy. Errors are fixed to meet IRS rules. They also organize forms in a simple system. Clients can find any form quickly when needed.

-

Audit Help

Tax experts guide clients if the IRS checks them. They show how to respond without mistakes. They also communicate with the IRS on the client’s behalf. This reduces stress during audits.

-

Advice on Rule Changes

Clients get alerts when IRS rules change. Experts help adjust forms to stay correct. They also explain how rules affect deductions or refunds. Clients stay compliant without guessing rules.

-

Make Custom Plans

Services match the client's money and tax needs. Each client gets clear steps to follow. They also adjust plans as income or costs change. American tax consultants provide clients with updated advice year-round.

-

Help All Year

American tax consulting helps clients every month. Early advice avoids mistakes and late filings. They also remind clients of upcoming deadlines. This keeps filing smoothly and easily.

How American Tax Consultants Work

-

Check Finances Carefully

Experts look at all the money in and out. This keeps filing correct and helps clients plan. They also track trends to predict next year’s taxes. Clients feel confident with a clear money picture.

-

Step-by-Step Help

American tax consultants break forms into simple steps for each client. Clients finish forms without mistakes or stress. They also give examples for each step. This ensures forms are complete and correct.

-

Speak in Simple Words

American tax consultants explain IRS forms in plain, simple words for clients. Clients understand every step without confusion. They also answer questions until the client feels clear. Simple words make filing less stressful.

-

Keep Data Safe

All money and form details stay private. Clients trust tax experts to keep records safe. They also store information in secure systems. Data safety prevents misuse or leaks.

-

Plan Ahead

Experts show what to do before deadlines. Early planning avoids mistakes and extra work later. They also suggest small yearly actions to save money. Clients avoid surprises and late fees.

-

Organize Records

American tax consulting keeps client records and forms organized and ready. Good organization helps during filing or audits. They also suggest easy ways to track all income. Clients can find any document fast.

Problems Solved by American Tax Consultants

-

Many Income Sources

Experts manage salary, rent, and side work. Correct reports stop mistakes and IRS fines. They also track small payments and odd income sources. Clients can report everything without worry.

-

State and Federal Rules

Experts explain differences in state and federal rules. Clients file correctly without stress or confusion. They also guide clients through local tax rules. Filing is easier when all the rules are known.

-

Avoid Penalties

Experts make sure forms are sent on time. On-time forms stop fines and IRS charges. They also check for missing forms or reports. Clients avoid late fees and fines.

-

Hard Tax Rules

Experts show IRS codes in simple words. Clients can follow steps without mistakes or stress. They also give examples to make the rules clear. Filing is simple when the rules are explained well.

-

Stay Updated

American tax consulting tracks IRS rule changes and alerts clients promptly. Clients stay compliant with all current rules. They also explain why changes may affect payments. Clients act early and avoid penalties.

-

Keep Correct Records

All forms and papers are ready for IRS checks. Experts make sure records are clear and correct. They also help organize past forms for easy use. Clients are always prepared for IRS requests.

American tax consultants make IRS filing simple and safe. Their help lowers mistakes, increases refunds, and stops fines. People and firms gain confidence in handling taxes well. Advice all year keeps filing smoothly, and stress is low.

Accounts Junction provides accounting and bookkeeping services for people and firms. We have certified experts to manage filings, deductions, and audits efficiently. Clients receive clear and simple plans throughout the year. Accounts Junction keeps forms accurate, secure, and ready at all times. Our team ensures clients maximize savings and manage taxes properly. Partner with us to streamline your accounting needs and ensure peace of mind.

FAQs

1. What do American tax consultants do?

- They help people and firms file IRS forms correctly. They also guide clients step by step, clearly.

2. Can consultants handle many income sources?

- Yes, they manage salary, rent, and side income. They track small and odd payments for accuracy.

3. Do they help during IRS audits?

- Yes, experts guide clients and show what to do. They also communicate with the IRS to reduce stress.

4. Are services good for small firms?

- Yes, consultants help small firms file taxes correctly. They also suggest ways to reduce tax bills.

5. Do consultants track multi-state rules?

- Yes, they check all state and federal rules. They remind clients of deadlines and report requirements.

6. Do consultants give advice year-round?

- Yes, clients get help for taxes all year. They also plan ahead to avoid errors.

7. Is client data safe with consultants?

- Yes, all records and forms are kept secure. They use safe systems to store sensitive data.

8. Can consultants help get full refunds?

- Yes, experts find deductions to increase client refunds. They also check for overlooked tax benefits.