All In One Accounting - The Leader in Outsourced Accounting

Managing finances is a big part of running a business, but it’s not always easy—or fun. That’s where All In One Accounting comes in, offering a simple, stress-free way to handle your books. Curious about outsourced accounting pricing, the cost to outsource accounting, or if it’s cheaper than in-house options? This blog breaks it down simply, showing why All In One Accounting leads the field.

What Is All-in-One Accounting?

All In One Accounting offers outsourced accounting services to simplify managing your business finances. You can avoid hiring a full-time accountant or managing numbers on your own. Their expert team takes care of everything, including bookkeeping and financial planning.

Think of it as a one-stop shop for all your accounting needs—hence the name! They’re designed to save you time, keep your books accurate, and help your business grow without the fuss of doing it all on your own.

This approach is perfect for small businesses, startups, or even growing companies that don’t want to deal with the complexity of in-house accounting. With all-in-one accounting, you get professional help tailored to your needs, all while keeping things simple and affordable.

Why Businesses Choose Outsourced Accounting

So, why are more businesses turning to outsourced accounting? For starters, it’s a huge time-saver. Business owners often wear many hats, and crunching numbers can eat up hours that could be spent on growing the company. Outsourcing lets you focus on what you do best while the pros handle the finances.

Another big reason is expertise. Companies like all-in-one-accounting bring years of experience and know-how to the table, ensuring your books are done right. Plus, the cost to outsource accounting is often lower than hiring a full-time staff member—more on that later. It’s also flexible; as your business grows, your accounting needs can scale up without the hassle of hiring more people.

Finally, it reduces stress. Tax season, payroll, and financial reports can be overwhelming, but outsourcing takes that burden off your shoulders. It’s no wonder so many businesses are jumping on board with this approach.

Outsourced Accounting Pricing

One of the first questions people ask is, “What’s the outsourced accounting pricing like?” The answer depends on a few things, like the size of your business, how many transactions you have, and what services you need. With all-in-one accounting, pricing is straightforward and designed to fit different budgets.

- Small Businesses (Basic Needs): $500 to $1,000 per month (typically includes bookkeeping and monthly reports).

- Businesses with More Needs: $1,500 to $5,000 per month (may include tax preparation or financial forecasting).

- Bigger Companies (Complex Finances): Higher rates, but still often a predictable flat fee.

What’s great about outsourced accounting pricing is that it’s often a flat fee, so you know exactly what you’re paying each month. No surprises and no hidden costs—just clear, affordable pricing that works for you.

Key Features of a Reliable Outsourced Accounting Service

Not all outsourced accounting services are the same, so what makes all-in-one accounting a leader? Here are some must-have features to look for in any reliable provider:

- Accuracy: Your numbers need to be spot-on, every time. A good service double-checks everything.

- Flexibility: Whether you need basic bookkeeping or advanced financial advice, they should adapt to your needs.

- Communication: You want a team that’s easy to reach and explains things in plain language.

- Technology: Advanced software keeps your data safe and makes tracking finances a breeze.

- Experience: A team with a proven track record, like all-in-one accounting, gives you peace of mind.

These features ensure you’re getting value for your money and a service you can trust. With all-in-one accounting, you get all this and more, making it a standout choice.

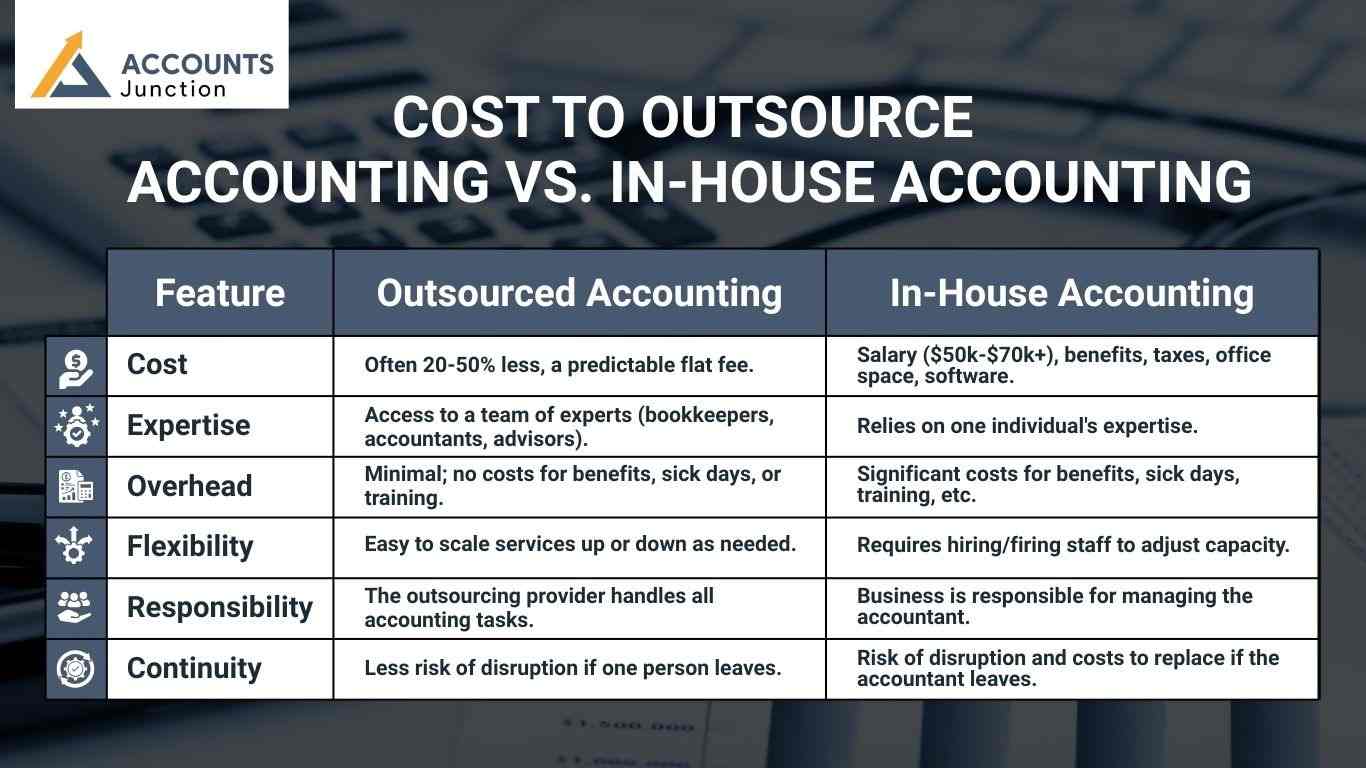

Cost to Outsource Accounting vs. In-House Accounting

Now, let’s tackle the big question: Is it cheaper to outsource accounting than to keep it in-house? The short answer is usually yes, and here’s why.

|

Feature |

Outsourced Accounting |

In-House Accounting |

|

Cost |

Often 20-50% less, a predictable flat fee. |

Salary ($50k-$70k+), benefits, taxes, office space, software. |

|

Expertise |

Access to a team of experts (bookkeepers, accountants, advisors). |

Relies on one individual's expertise. |

|

Overhead |

Minimal; no costs for benefits, sick days, or training. |

Significant costs for benefits, sick days, training, etc. |

|

Flexibility |

Easy to scale services up or down as needed. |

Requires hiring/firing staff to adjust capacity. |

|

Responsibility |

The outsourcing provider handles all accounting tasks. |

Business is responsible for managing the accountant. |

|

Continuity |

Less risk of disruption if one person leaves. |

Risk of disruption and costs to replace if the accountant leaves. |

For many small to mid-sized businesses, outsourcing accounting emerges as a financially advantageous choice, offering access to expertise without the substantial overhead associated with a full-time employee, though larger enterprises might have different considerations.

How Outsourced Accounting Can Improve Business Decisions

Outsourced accounting can do more than just manage numbers. With clear and organized financial records, business owners can see where money is going and make smarter decisions.

Benefits for Your Business

- Better Planning: Knowing your income and expenses clearly may help you plan budgets or expansions.

- Identify Patterns: Experts can spot trends that might be missed otherwise.

- Cost Control: Highlight areas where spending can be reduced without hurting the business.

- Focus on Growth: With finances handled, owners can spend more time on growing their business.

Even small insights from outsourced accounting can make a big difference in business strategy and decision-making.

Common Misconceptions About Outsourcing Accounting

Many business owners hesitate to outsource accounting because of myths and fears. Understanding the facts may help you make a better choice.

Myths vs. Reality

- Outsourcing is impersonal: Most providers offer personal support and regular updates.

- Only for big companies: Small businesses and startups can gain a lot from outsourcing.

- It is expensive: Outsourcing may often cost less than hiring a full-time accountant.

- Loss of control: You still get reports and insights, keeping you in charge of decisions.

Clearing up these misconceptions can reduce hesitation and help business owners see the real value of outsourcing.

Tips to Choose the Right Outsourced Accounting Provider

Choosing the right accounting service is important for smooth financial management. Here are some tips to guide your choice.

Key Points to Consider

- Experience: Look for a team that has worked with businesses like yours.

- Technology: Ensure they use safe and easy-to-use software for tracking finances.

- Communication: Make sure they explain things clearly and answer your questions.

- Pricing: Check that costs are clear and there are no hidden fees.

- Reviews: Look at testimonials or past client feedback to see their reliability.

Following these steps can save time, reduce stress, and make sure your business finances are in good hands.

Feeling overwhelmed by your business finances or worried about accounting costs? Outsourcing with Accounts Junction can be the answer. We offer clear, budget-friendly pricing, often more affordable than hiring in-house. Let us handle the complexities of your financial management, providing expert support to keep things straightforward and stress-free. With Accounts Junction, you can focus on growing your business, knowing your finances are in good hands.

FAQs

1. What services does all-in-one-accounting provide?

- They handle bookkeeping, payroll, tax help, and financial reports. Their team manages all key accounting tasks for businesses.

2. How much does an all-in-one accounting cost?

- Pricing depends on business size and services. Plans start around $500 per month and go up for larger needs.

3. Is outsourcing accounting cheaper than hiring in-house?

- Yes, it often costs 20-50% less than a full-time accountant. Businesses may save on Salary, benefits, and office space.

4. Can all-in-one accounting help small businesses?

- Absolutely. Small companies can get professional accounting without hiring a full-time staff.

5. Can an all-in-one accounting handle multiple clients or projects?

- Yes, they can manage finances for businesses with several clients or projects. This keeps all accounts organized and easy to track.

6. What makes all-in-one accounting different from other providers?

- They focus on simplicity, clear pricing, and personalized support. Their experience ensures accurate and reliable accounting.

7. Does all-in-one accounting handle taxes?

- Yes, they may manage tax filing and preparation. This helps reduce mistakes and saves time for business owners.

8. Can outsourcing improve financial reporting?

- Yes, all-in-one accounting provides regular and accurate reports. Businesses can see their finances clearly.

9. How does outsourcing reduce stress for business owners?

- It takes financial tasks off your plate. Owners can focus on growth rather than bookkeeping or payroll.

10. Is all-in-one accounting suitable for startups?

- Yes, startups can benefit from professional guidance without high costs. It helps them grow while keeping finances organized.

11. How long does it take to start with all-in-one accounting?

- Setup is usually quick and smooth. Experts may organize existing records and start tracking finances right away.

12. Can all-in-one accounting help with budgeting and planning?

- Yes, they provide insights into spending and cash flow. This may help businesses make smarter financial decisions.

13. Can all-in-one accounting help me understand my financial data?

- Yes, they explain reports in simple language. You can make informed decisions without confusion.

14. Is all-in-one accounting suitable for businesses with seasonal income?

- Yes, they can manage fluctuating revenue and adjust services accordingly. This helps maintain financial stability year-round.

15. Can an all-in-one accounting system save money compared to hiring staff?

- Yes, outsourcing avoids salaries, benefits, and office costs. Flat-fee plans make expenses predictable.

16. How often will I receive financial updates?

- Reports are usually monthly, but custom schedules are possible. This ensures you always know your business’s financial health.

17. Is all-in-one accounting suitable for mid-sized businesses?

- Yes, mid-sized companies can benefit from expert accounting without adding overhead. Plans scale to match complexity.

18. Why should I consider all-in-one accounting over other providers?

- They combine affordable pricing, clear communication, and professional expertise. This creates stress-free and reliable accounting support.

19. How does all-in-one accounting make outsourced accounting easy for small businesses?

- They handle bookkeeping, payroll, taxes, and reports all in one place. This lets small Businesses focus on growth instead of managing finances.

20. Can an all-in-one-accounting handle multiple clients or projects?

- Yes, they can manage finances for businesses with several clients or projects. This keeps all accounts organized and easy to track.

21. Can an all-in-one accounting software reduce the cost of outsourcing accounting?

- Yes, their flat-fee plans often cost less than hiring full-time staff. Businesses can get expert services without extra overhead.