Accurate and Reliable Bookkeeping Solutions for Small Restaurants

Running a small restaurant can be fun. It is also very challenging. One big challenge is handling money. Proper bookkeeping, including bookkeeping solutions for small restaurants, keeps the business smooth and organized. Without good records, restaurants can face losses. They can also have tax issues and confusion. This is why bookkeeping is very important.

Bookkeeping tracks daily sales and costs. It also tracks profits clearly. Records make sure no expense is missed. They also ensure all income is counted. This helps owners make smart choices. It helps with pricing, staff, and stock.

A good system helps plan for the future. Owners can check cash flow easily. They can also manage budgets better. It shows trends in sales and costs. This prevents sudden money problems. Proper bookkeeping follows all tax rules.

Bookkeeping makes the business more efficient. Organized records make audits easier. It shows which areas need work. It helps pay vendors on time. It also controls food waste and costs. It keeps profit margins healthy.

Hiring bookkeeping help saves time. It reduces stress for restaurant owners. They can focus on serving customers. They can also grow the business. Good records make money tasks simple. Proper bookkeeping helps restaurants succeed.

Why Bookkeeping is Essential for Small Restaurants

1. Track Daily Sales

- Record sales every day. This helps plan menus and stock. You can see what sells fast or slow.

2. Manage Expenses

- Track food costs, bills, and staff wages. This helps keep spending under control. Budgets stay balanced.

3. Control Profits

- Check which dishes make money. Identify items that reduce profits. This helps improve overall earnings.

4. Prepare for Taxes

- Bookkeeping helps keep records neat and ready for tax season. It makes filing simple and ensures all deductions are claimed.

5. Avoid Financial Errors

- Track cash and accounts with care. Clear records stop mistakes and reduce losses.

6. Plan for Growth

- Bookkeeping shows business trends. Use this to plan new branches or added services.

7. Monitor Inventory

- Check stock often to avoid waste and shortages. Effective tracking saves money and cuts extra costs.

8. Evaluate Staff Performance

- Track staff costs and output with care. This helps plan shifts and boost work results.

9. Make Informed Decisions

- Effective books guide menu, price, and sales plans. Clear data helps owners choose the best steps.

10. Improve Customer Service

- Know peak times and top dishes well. This helps serve guests faster and with care.

11. Control Cash Flow

- Track money coming in and going out. Ensure bills are paid and cash is available.

Hire A Dedicated Team

That Grows With You, Flexible, Scalable and

Always On Your Side

Common Challenges Small Restaurants Face

1. High Staff Turnover

- Frequent staff changes cause pay and shift issues. Training often adds cost and lowers service.

2. Cash Handling Errors

- Manual cash records often cause mistakes or theft. Poor cash control reduces funds available for key expenses.

3. Inventory Loss

- Poor stock tracking leads to waste and high costs. Missing items cause errors in profit counts.

4. Time Management

- Restaurant owners spend too much time on accounting tasks. This limits focus on staff, menu, and customer service.

5. Tax Compliance

- Small restaurants may miss deadlines or file incorrect tax returns. Errors often result in fines and financial stress.

6. Rising Operational Costs

- Rent, bills, and supply costs may rise fast. If not tracked, they cut profit and slow growth.

7. Poor Financial Planning

- Weak budgeting makes it hard to forecast revenue or expenses. Poor planning can lead to cash flow problems quickly.

8. Limited Technology Adoption

- Manual tasks slow down daily work and reports. Lack of tools lowers speed and cuts efficiency.

9. Customer Retention Challenges

- Poor service or weak loyalty plans cut repeat sales. Low retention forces more spending on marketing.

10. Regulatory Changes

- Health and safety rules change often and can be complex. Non-compliance harms reputation and may lead to fines.

Using bookkeeping solutions for small restaurants can fix these issues efficiently.

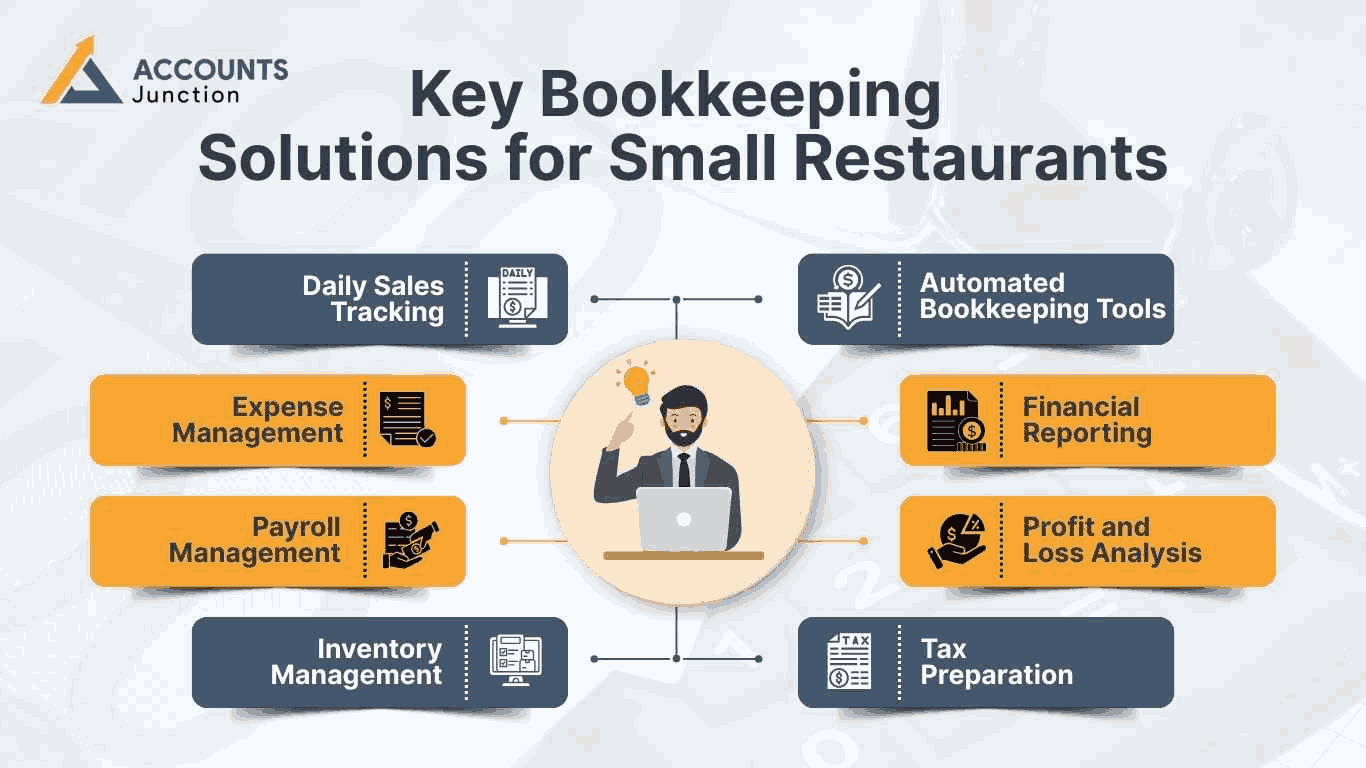

Key Bookkeeping Solutions for Small Restaurants

1. Daily Sales Tracking

- Record all cash and card sales every day.

- Compare sales with past days to see trends.

- Helps find peak hours and best-selling dishes.

2. Expense Management

- Implement bookkeeping solutions for small restaurants to track all costs like food, drinks, and supplies accurately.

- Include rent, bills, and staff payments.

- Helps cut unnecessary spending.

3. Payroll Management

- Keep accurate salary records.

- Calculate wages, bonuses, and deductions correctly.

- Ensure staff are paid on time each month.

4. Inventory Management

- Track all ingredients and supplies.

- Monitor expiry dates to avoid waste.

- Helps order the right quantity of stock.

5. Tax Preparation

- Organizing bills and invoices is easier with bookkeeping solutions for small restaurants.

- Record taxes collected and paid.

- Makes tax filing simple and error-free.

6. Profit and Loss Analysis

- Calculate net profit regularly.

- Know which dishes or services are profitable.

- Helps make smart business choices.

7. Financial Reporting

- Generate weekly and monthly reports.

- Review the business’s financial health.

- Makes loan or investor applications easier.

8. Automated Bookkeeping Tools

- Use software to record sales and expenses automatically.

- Cuts manual mistakes and saves time.

- Gives real-time data for faster decisions.

Benefits of Professional Bookkeeping Solutions

- Saves Time

Professional bookkeeping solutions for small restaurants save time by managing all accounting tasks efficiently. This lets owners focus on cooking and serving customers. - Reduces Errors

Records are accurate and mistakes are rare.

This keeps money tracking correct and simple. - Helps Make Better Decisions

Bookkeeping solutions for small restaurants provide reports that clearly show money inflow and outflow. This helps plan prices, menus, and daily work. - Keeps You Compliant

Bookkeeping follows tax rules and laws carefully.

It avoids fines, penalties, and legal trouble. - Gives Financial Insights

Bookkeepers find ways to save money and grow profit.

They show how to improve the business and plan ahead.

How Small Restaurants Can Implement Bookkeeping Solutions

- Hire a Professional

Get a bookkeeper or accountant to handle finances.

They keep records correct and save you time.

- Use Cloud Software

Online bookkeeping solutions for small restaurants help track sales, expenses, and inventory efficiently. It keeps data safe and easy to check anytime.

- Train Your Staff

Teach staff to record sales and costs every day.

Daily records help avoid mistakes and keep books accurate.

- Check Accounts Monthly

Compare your bank and cash records with your books every month.

This ensures all money is recorded correctly.

- Look at Reports

Check monthly reports for profits, losses, and spending.

Reports help you make better choices for your restaurant.

Tips for Maintaining Accurate Books

- Record Sales Every Day

Write down all sales each day without delay.

Daily records keep your money tracking correct and easy.

- Update Inventory Often

Check your stock regularly to know what you have.

This helps avoid running out or keeping too much.

- Separate Personal and Business Expenses

Do not mix personal money with business money.

This makes taxes easier and stops mistakes in records.

- Review Books Monthly

Go through your records once a month carefully.

Monthly reviews find errors and help plan your finances.

- Reconcile Bank Accounts Weekly

Check your bank account against your books every week.

This ensures all deposits and payments are correct.

- Track Cash Carefully

Record every cash transaction right away.

Accurate cash tracking prevents loss and helps make decisions.

- Use Accounting Software

Use simple software to keep books easier.

Software calculates totals and produces clear reports.

- Categorize Expenses

Put expenses into clear groups to see spending.

This helps with reports, budgets, and tax filing.

- Back Up Records

Save copies of all records often.

Backups protect information if files are lost.

- Check Profit and Loss

Look at profit and loss statements monthly.

This shows how the business is doing and what to fix.

Choosing the Right Bookkeeping Solution

When picking bookkeeping solutions for small restaurants, check:

- Ease of Use: Should be simple for staff to learn.

- Cost-Effective: Should fit the restaurant budget.

- Reporting Features: Can generate fast and clear reports.

- Integration: Works with POS and payroll systems.

- Support: Offers help when needed.

Running a small restaurant is exciting. Managing money can be very challenging. Owners must track daily sales. They also need to pay staff, manage bills, and handle taxes. Small mistakes can reduce profits. They can also slow business growth. Reliable bookkeeping helps keep financial records clear and accurate. It makes spotting errors easy. It also supports smart financial decisions.

Accounts Junction offers professional bookkeeping services for small restaurants. Every transaction is recorded correctly. Reports are simple to read and understand. Clear financial insights help owners focus on serving customers. We can also focus on growing the business. Partnering with Accounts Junction ensures accurate records. It provides timely reports and peace of mind. With expert support, small restaurants can save time. We can reduce stress and plan for long-term success.

FAQs

1. Why is bookkeeping important for small restaurants?

- It tracks sales, costs, and profits for smart money management.

2. How can I reduce errors in restaurant bookkeeping?

- Use software and record daily sales and expenses.

3. Can I do bookkeeping myself?

- Yes, but professional solutions save time and reduce mistakes.

4. What software is best for small restaurants?

- Cloud-based accounting software works well for sales and inventory tracking.

5. How often should I review financial reports?

- Monthly reviews help spot issues and plan growth.

6. Does bookkeeping help with taxes?

- Yes, it organizes records to make tax filing easy and correct.

7. Can bookkeeping solutions improve profits?

- Yes, tracking costs and sales identifies ways to increase revenue.