Accounts Receivable Collection - Increase AR Efficiency by 3x

Managing cash flow is vital for any business, and accounts receivable plays a key role in ensuring financial stability. When businesses sell products or services on credit, they rely on timely payments to maintain smooth operations. It is called accounts receivable collection.

Accounts receivable is the amount a business expects to receive from customers for products or services already provided. It represents the money owed to a company and is recorded as an asset on the balance sheet. Efficient accounts receivable management ensures a steady cash flow, reducing financial strain and improving overall business operations.

Why Accounts Receivable Efficiency Matters for Business Growth

Managing accounts receivable collection efficiently is crucial for business success. Delayed payments can lead to cash flow issues, affecting payroll, inventory management, and operational expenses.

Improved accounts receivable collection efficiency helps businesses:

- Maintain a steady cash flow.

- Reduce the risk of bad debts.

- Improve customer relationships through structured invoicing.

- Allocate resources effectively for growth and expansion.

- Enhance financial planning and forecasting.

- Minimize operational disruptions due to cash shortages.

- Improve creditworthiness and business reputation.

- Reduce dependency on short-term loans and external funding.

- Strengthen internal financial controls and decision-making.

Key Challenges in Accounts Receivable Collection

Managing accounts receivable collection can be complex, and businesses often struggle to maintain efficiency in collections. Despite its importance, businesses often face challenges in accounts receivable collection, such as:

1. Late Payments

- Customers delaying payments disrupt cash flow and increase the risk of unpaid invoices. Late payments can also strain relationships with vendors and suppliers, affecting business operations.

2. Disorganized Invoicing

- The Lack of a structured invoicing system leads to missed payments and disputes. Inconsistent or unclear invoices can cause confusion and further delay payments.

3. Ineffective Follow-ups

- Without a consistent follow-up strategy, overdue payments can accumulate. Businesses may struggle to track outstanding invoices, leading to longer collection cycles.

4. Customer Disputes

- Errors in billing or miscommunications can delay payments and strain client relationships. Disputes often arise due to incorrect amounts, missing details, or delayed invoice submissions.

5. Lack of Automation

- Manual processes slow down collection efforts and increase administrative workload. Automation helps streamline invoicing, payment tracking, and follow-ups, reducing human errors.

6. Inadequate Credit Policies

- Extending credit without proper evaluation increases the risk of default. Setting clear credit terms and assessing customer reliability helps businesses prevent bad debts.

7. Inconsistent Application of Credit Terms

- Even with established credit policies, inconsistent application can lead to confusion and disputes. Varied treatment of different customers can create resentment and delay payments.

8. Poor Data Management and Accuracy

- Inaccurate customer data, such as incorrect contact information or outdated billing addresses, can hinder collection efforts.

9. Global and Cross-Border Challenges

- Dealing with international clients introduces complexities like currency fluctuations, varying payment regulations, and language barriers, which can significantly delay collections.

Why Follow-Ups May Shape the Whole AR Cycle

Sometimes, it isn’t the invoice that delays payment, it’s the silence that follows it. When no one checks in, clients may forget. When reminders stay steady, money may flow faster.

Steps to Create a Smooth Follow-Up Flow

- Plan the first contact: A gentle reminder within a few days after the due date often works better than waiting too long.

- Use varied channels: Some people read emails, others answer calls. Mixing both can lift response rates.

- Keep tone polite but firm: Clients may respond quicker when the message stays calm yet clear.

- Record each contact: A log helps track when you reached out and what was said, keeping confusion away.

The Balance Between Firmness and Flexibility

A small delay may not mean unwillingness.

Sometimes, giving a short grace period can turn an overdue client into a loyal one.

Collections can be firm, yet kind.

How to Increase AR Efficiency by 3x

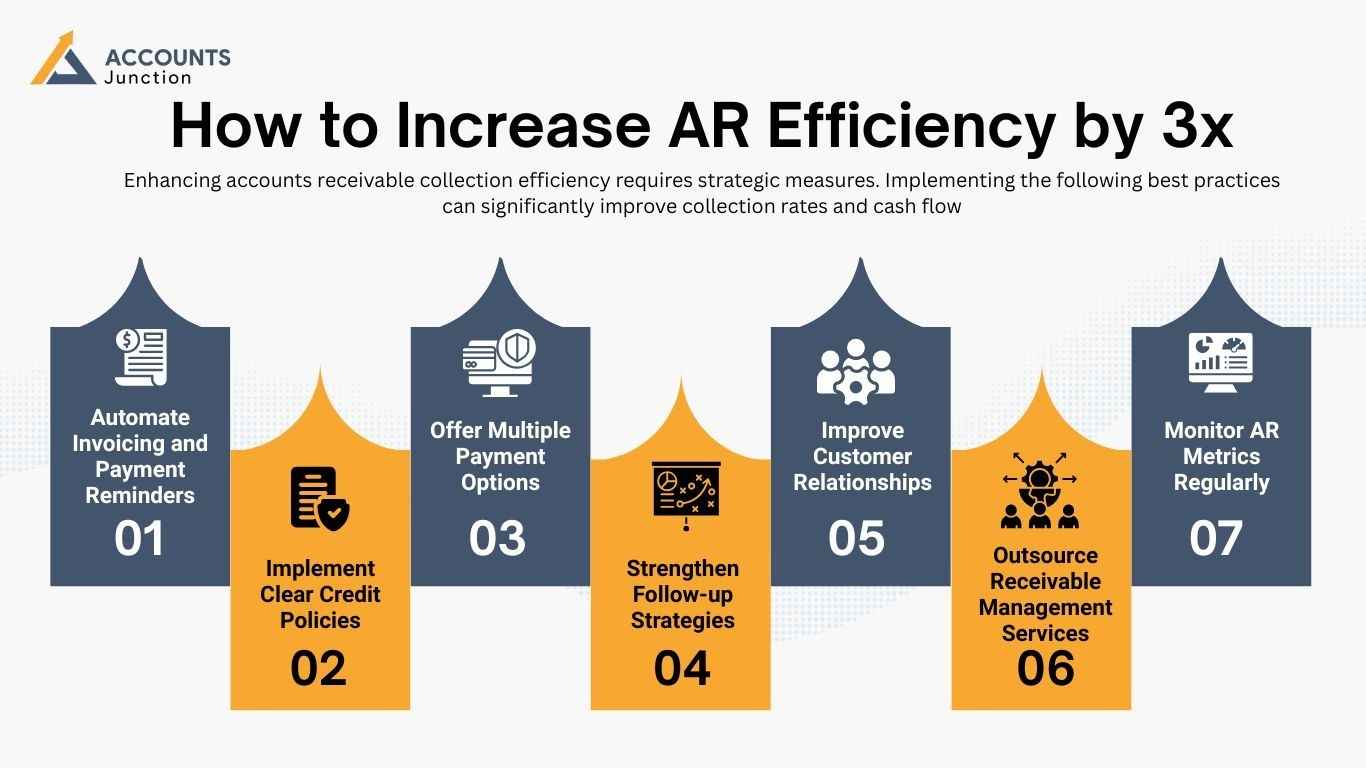

Enhancing accounts receivable collection efficiency requires strategic measures. Implementing the following best practices can significantly improve collection rates and cash flow:

1. Automate Invoicing and Payment Reminders

- Using accounting software ensures invoices are generated promptly and sent automatically. Payment reminders help reduce late payments.

2. Implement Clear Credit Policies

- Establishing well-defined credit terms and conducting credit checks can reduce payment defaults.

3. Offer Multiple Payment Options

- Offering different payment options like credit cards, bank transfers, and digital wallets helps customers pay on time.

4. Strengthen Follow-up Strategies

- Consistent and professional follow-ups via emails, calls, or automated reminders can accelerate payments.

5. Improve Customer Relationships

- Effective communication with clients about billing details and payment expectations builds trust and encourages timely payments.

6. Outsource Receivable Management Services

- Partnering with receivable management services ensures professional handling of collections, reducing internal workload and improving efficiency.

7. Monitor AR Metrics Regularly

- Tracking key performance indicators like Days Sales Outstanding (DSO) helps businesses identify inefficiencies and optimize collection strategies.

Using Analytics to Predict and Prevent Delays

Sometimes, numbers speak before trouble arrives. Analytics can show who pays late, who pays on time, and who may not pay at all.

What to Track in Accounts Receivable Collection Reports

- Aging report: Shows how long invoices stay unpaid.

- Payment trend charts: Can help see if delays are getting longer.

- Customer behavior data: Helps find repeat offenders before the next sale.

- Collection success rate: Tells how well your follow-up system performs.

Turning Data into Action

Data alone can sit still, but insight moves fast. Once patterns appear, businesses may change terms, send reminders sooner, or tighten credit lines. Every insight may save a loss before it happens.

Our Receivable Management Services for Boosting AR Efficiency

We provide specialized receivable management services to help businesses enhance their accounts receivable collection efficiency. Our services include:

1. Automated Invoicing and Payment Tracking

- We streamline invoicing and set up automated payment tracking to ensure timely collections.

2. Credit Risk Assessment

- Our team evaluates customers’ creditworthiness before extending credit, reducing the risk of bad debts.

3. Customized Follow-up Solutions

- We implement tailored follow-up strategies, including automated reminders and personalized communication.

4. Dispute Resolution Management

- We help resolve billing disputes promptly to prevent payment delays and maintain strong client relationships.

5. Advanced Reporting and Analytics

- Our receivable management services provide businesses with insights into their AR performance, allowing data-driven decision-making.

6. Compliance and Regulatory Assistance

- We ensure that businesses adhere to financial regulations and industry standards while managing accounts receivable collection.

Improving accounts receivable collection efficiency ensures steady cash flow and reduces financial risks. Automating invoicing, setting clear credit policies, and following up consistently help businesses get paid on time.

Accounts Junction provides receivable management services to streamline collections and optimize financial processes. With expert solutions, businesses can reduce overdue payments and improve financial stability.

FAQs

1. What is accounts receivable collection?

- It is the process of tracking and collecting money owed by customers after they buy on credit.

2. Why does AR efficiency matter so much?

- When AR runs well, cash keeps flowing, and the business stays stable and calm.

3. How can automation help in AR management?

- Automation can send invoices faster, remind clients on time, and reduce missed payments.

4. What happens if customers often pay late?

- Late payments may create cash flow gaps and make it harder to cover regular expenses.

5. Can better communication improve collections?

- Yes, clear and kind communication may lead to faster and smoother payments.

6. Why do businesses face AR challenges?

- It can be due to poor invoicing, unclear terms, or even lack of follow-up systems.

7. How can companies reduce payment delays?

- Setting clear terms, sending reminders, and offering flexible payment options can help.

8. What is DSO in AR management?

- DSO, or Days Sales Outstanding, tells how many days it takes to collect payment after a sale.

9. Can small businesses use automation for AR?

- They sure can. Many affordable tools are made just for small teams.

10. How can disputes affect receivable collection?

- Even small billing errors can cause long payment delays if not fixed early.

11. Is outsourcing AR collection risky?

- Not usually. Trusted firms follow clear guidelines and act professionally.

12. What if a customer refuses to pay?

- Businesses may first try gentle reminders, then formal notices, or legal steps if needed.

13. Can offering discounts help in faster payments?

- Sometimes, yes. Early payment discounts may encourage quick settlements.

14. How often should businesses review their AR reports?

- Monthly reviews may help track trends and find delays before they grow.

15. How can data accuracy affect AR results?

- Wrong contact info or outdated records may lead to missed invoices and delayed funds.

16. What are good signs of strong AR management?

- Low overdue amounts, steady cash flow, and fewer disputes often mean strong AR systems.

17. Can receivable software connect with QuickBooks or Xero?

- Yes, most modern AR tools sync easily with popular accounting platforms.

18. Why should credit policies be reviewed often?

- Because markets, clients, and risks change. What worked once may not work now.

19. What is the best way to follow up with overdue clients?

- A polite email first, a reminder call later, and a final notice if needed — that order works best.

20. How can AR collection affect customer relationships?

- When handled with care, it may actually build trust, not harm it. Customers value fairness and clarity.