What is the role of accounting in travel agency?

A travel agency requires accurate and timely reporting of all the financial transactions of the business to assess its profitability and sustainability. Accounting in travel agency plays a vital role for smooth operations, ensuring accurate financial records, regulatory compliance, and informed decision-making. In this article, we will explore the need for accounting for travel agencies and how accountants contribute to the financial well-being of travel companies.

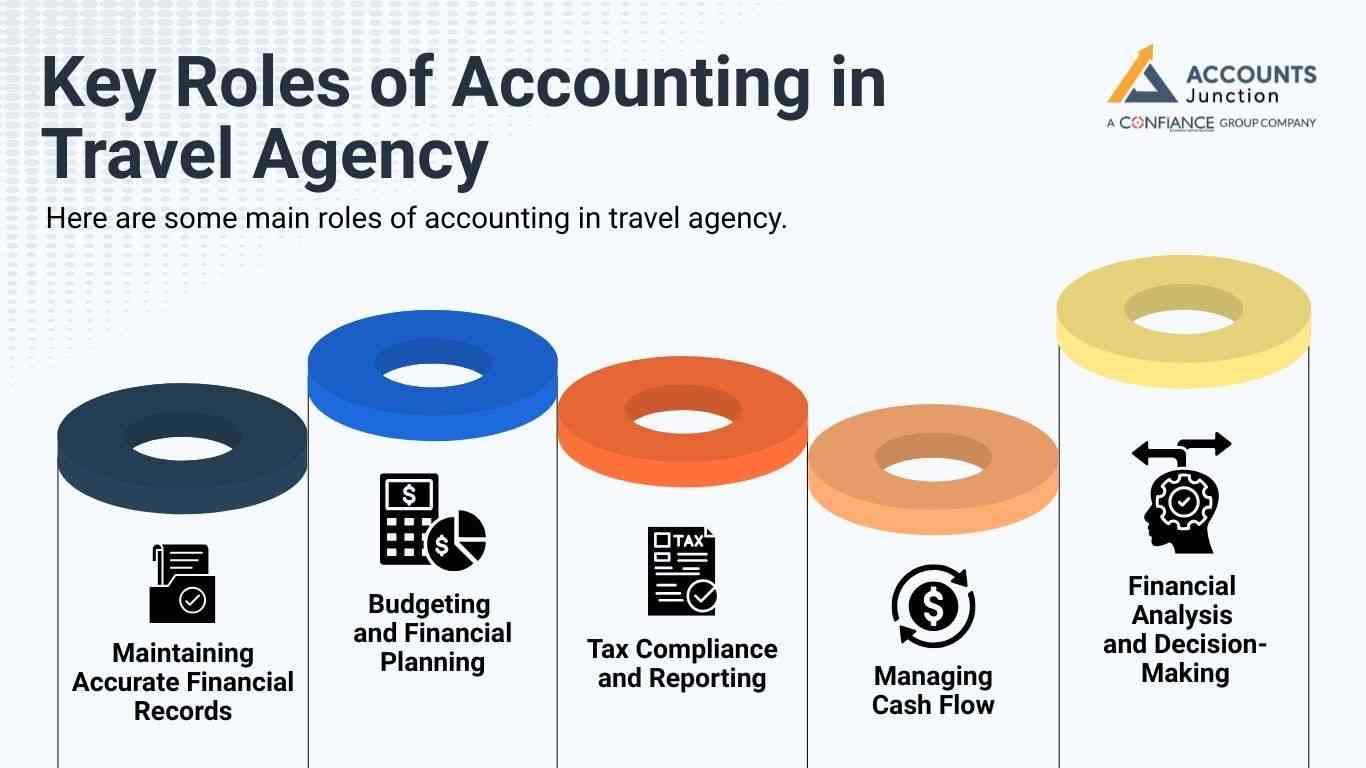

Key Roles of Accounting in Travel Agency

Here are some main roles of accounting in travel agency:

Maintaining Accurate Financial Records

Accounting is the backbone of any business, including travel agencies. Accountants for travel agents play a pivotal role in ensuring the integrity of financial records, tracking revenue and expenses, and providing a clear picture of the agency's financial health. This allows travel agencies to monitor their financial performance, identify areas for improvement, and make informed business decisions.

Budgeting and Financial Planning

Travel agencies need to plan their finances strategically to ensure profitability and growth. Accountants specializing in travel company accounting assist in creating budgets and financial plans that align with the agency's goals. They analyze historical financial data, market trends, and business forecasts to develop realistic budgets and identify potential risks and opportunities. By having a well-designed financial plan, travel agencies can allocate resources efficiently, control costs, and maximize profitability.

Tax Compliance and Reporting

Travel agencies are subject to various tax obligations, including income tax, sales tax, and payroll tax. Accountants with expertise in travel company accounting help navigate complex tax regulations, ensuring compliance and minimizing the risk of penalties. They assist in preparing and filing accurate tax returns, keeping track of tax deadlines, and implementing effective tax strategies. By staying compliant, travel agencies can avoid legal issues and maintain a healthy financial standing.

Managing Cash Flow

Maintaining a healthy cash flow is vital for the survival and growth of any business, including travel agencies. Accountants for travel agents monitor cash inflows and outflows, predict future cash needs, and implement strategies to optimize cash flow. They analyze payment patterns, manage accounts receivable and payable, and offer advice on managing working capital effectively. By ensuring a steady cash flow, travel agencies can meet their financial obligations, invest in growth opportunities, and weather economic fluctuations.

Financial Analysis and Decision-Making

Accountants in travel agencies provide valuable financial analysis that aids decision-making. They generate financial reports, such as profit and loss statements, balance sheets, and cash flow statements, and interpret the data to identify trends, patterns, and areas of concern. By evaluating financial performance, accountants assist travel agency owners and managers in making informed decisions regarding pricing strategies, cost controls, investment opportunities, and expansion plans.

Accountants specializing in travel company accounting contribute to the efficient operation of these agencies by maintaining accurate financial records, budgeting, and financial planning, ensuring tax compliance, managing cash flow, and providing financial analysis for decision-making.

Types of Accounting in Travel Agency

Here are the main types of accounting in travel agency:

1. Financial Accounting

Financial accounting keeps track of every money move inside a travel agency. It records sales, vendor payments, commissions, refunds, and operating expenses. It also prepares key financial statements like the balance sheet, income statement, and cash flow report. These statements help owners, lenders, and investors see the true financial health of the agency.

2. Managerial Accounting

Managerial accounting supports leaders inside the agency. It studies sales trends, route performance, package profits, staff output, and peak season data. Managers use this insight to plan tours, adjust prices, control budgets, and improve daily operations. It helps the agency respond fast to changes in demand.

3. Cost Accounting

Cost accounting looks at all service costs such as ticket booking fees, hotel charges, guide payments, transport rates, partner fees, and admin work. By tracking these costs, agencies can price travel packages in a smart way and protect their profit margin. It also helps reduce waste by showing where cost leaks happen.

4. Revenue Recognition

Travel agencies work with advance payments, deposits, and commissions from suppliers. Revenue recognition ensures these amounts are recorded at the correct time. For example, revenue from a tour is recognized when the service is delivered, not when the client pays in advance. This creates clear and fair financial reports. It also prevents disputes and helps stay audit ready.

Challenges in Travel Agency Accounting

Accounting in travel agency comes with several challenges. Here are some of them:

1. Managing Seasonal Fluctuations

Travel demand rises and falls during holidays, vacation months, and festival seasons. This creates uneven cash flow. Agencies must plan budgets well and maintain reserves to handle lean periods.

2. Handling Multi Currency Transactions

Travel agencies deal with clients and suppliers around the world. Exchange rates keep shifting which affects profit margins. Proper accounting tools and clear policy for currency conversion are needed to avoid loss.

3. Dealing with Cancellations and Refunds

Cancellations, rescheduling, and chargebacks are common in this industry. Each case affects revenue, vendor payments, and commissions. Agencies must track these adjustments carefully to avoid errors and disputes.

4. Navigating Complex Tax Rules

Travel services fall under many tax laws such as GST or VAT, service taxes, and international travel taxes. Rates differ from region to region. Accounting teams must keep track of these rules to stay compliant and prevent penalties.

Technology and Tools for Travel Agency Accounting

Modern travel agencies use smart tools to speed up their work and reduce errors. Travel management systems link with accounting software to sync bookings, invoices, refunds, vendor bills, and reports.

Popular tools include QuickBooks, Xero, Zoho Books, Tally, and special travel agency software that handles ticketing and tour booking.

These systems help by automating invoice creation, tracking vendor payments, recording client receipts, and producing real time financial reports. They reduce manual work, prevent billing mistakes, and make the agency more efficient.

Accounts Junction’s Travel Accounting Services

Accounts Junction offers expert accounting services designed for travel agencies of all sizes. We understand the unique needs of tour operators, ticketing firms, and travel planners. We manage bookkeeping, GST and VAT compliance, multi currency accounts, supplier payments, commission tracking, and revenue management.

With Accounts Junction, travel agencies get clean books, timely reports, and full support during audits. This gives owners more time to focus on clients while the team at Accounts Junction handles every financial detail with skill and care.

Explore accounting for travel agencies with us

We at Accounts Junction provide accounting and bookkeeping services to independent agencies, tourist agency owners, and franchisees. By leveraging the expertise of an experienced team of accountants at Accounts Junction, travel agencies can achieve financial stability, maximize profitability, and thrive in a competitive industry.

FAQs

1. Why is accounting important for travel agencies?

- Because it helps track sales, costs, vendor payments, and profits with accuracy.

2. What is the biggest challenge of accounting in travel agency?

- Managing refunds, cancellations, and multi currency transactions are some major challenges of accounting in travel agency.

3. How do travel agencies record advance payments?

- They record them as client advances and convert them to revenue when the service is delivered.

4. Do travel agencies need special accounting software?

- Yes. Tools built for travel firms help manage bookings, commissions, and foreign currency.

5. How is commission income recorded?

- It is recorded once the supplier confirms the commission earned on the booking.

6. How do agencies handle foreign exchange gains and losses?

- They adjust the value of the transaction based on the exchange rate at the time of payment.

7. What reports are needed for travel agency management?

- Sales reports, vendor aging, daily booking summary, profit by package, and cash flow reports.

8. How can an agency reduce accounting errors?

- By using automated systems for invoicing, receipts, and vendor payments.

9. How does cost accounting help travel agencies?

- It shows real costs of tours, tickets, rooms, and transport which helps with pricing.

10. What is the role of a travel accountant?

- To manage books, track commissions, handle GST, prepare statements, and guide cash flow.

11. How are cancellations recorded?

- They are recorded as negative revenue along with refunds or adjustments to vendor bills.

12. Can travel agencies claim input tax credit?

- Yes, if they follow GST rules and hold valid vendor invoices.

13. Why do travel agencies face cash flow issues?

- Because demand changes with seasons and many payments happen in advance.

14. What is the best way to manage supplier payments?

- Use software that tracks due dates and matches vendor bills with bookings.

15. How do travel agencies manage peak season accounting?

- By planning early, using automation, and updating reports daily.

16. Can accountants help with travel package pricing?

- Yes. They study costs and margins to suggest the right selling price.

17. What is revenue leakage in travel accounting?

- It means loss of income due to missed commissions, wrong rates, or billing mistakes.

18. How often should travel agencies reconcile accounts?

- At least once a month to ensure clear and accurate reports.

19. Do travel agencies need audit ready books?

- Yes. Clean records help with tax filing, funding, and business deals.

20. Can Accounts Junction manage full accounting in travel agency?

- Yes. We provide end-to-end remote services that cover bookkeeping, tax work, payroll, and financial reports for travel agencies.