Accounting For Startups: Everything You Need To Know In 2026

Starting a small business in 2026 is both exciting and tough. Many founders focus on sales, product, and team growth, but they often miss tracking money. Clear bookkeeping, supported by good accounting for startups, helps you see cash flow, expenses, and income trends. It also helps make better choices that guide the startup toward long-term success. Effective bookkeeping, a core part of accounting for startups, gives trust to funders and helps meet legal rules. Startups with clear money records can handle loans or investments with less stress. They can also spot mistakes early and plan for new work. Keeping books right is not just a task; it is key to success.

Why Bookkeeping and Accounting for Startups Matter

- Money Visibility

Keeping books, a step in accounting for startups, shows where cash comes from and goes. You can spot areas to save and spend more wisely. - Better Choices

Clear money records help plan hires, products, or marketing. It shows which work gives the best return on money. - Trust With Funders

Good records create trust with backers and loan providers. Clear books make funding and credit talks much easier. - Follow Rules

Books show you follow legal rules and pay taxes. This prevents fines and keeps the business safe.

Building a Strong Bookkeeping Base

-

Choose Business Type

The business type affects taxes, risk, and reports. Picking the right type keeps bookkeeping simple as you grow.

-

Keep Accounts Separate

Use one bank account for business, not personal funds. This avoids confusion and makes tax time easier.

-

Pick Bookkeeping Method

The cash method tracks money when it comes in or goes out. The accrual method tracks money when it is earned or owed.

-

Set Up Money Categories

Organize cash into assets, costs, income, and debts. Clear categories make reports and decisions simple.

-

Use Simple Software

Software is key in accounting for startups. It helps track payments, invoices, and receipts fast, reduces mistakes, and works well for growing teams.

-

Record Books Often

Regular updates are crucial in accounting for startups. Enter all transactions weekly or monthly to prevent errors and keep reports correct.

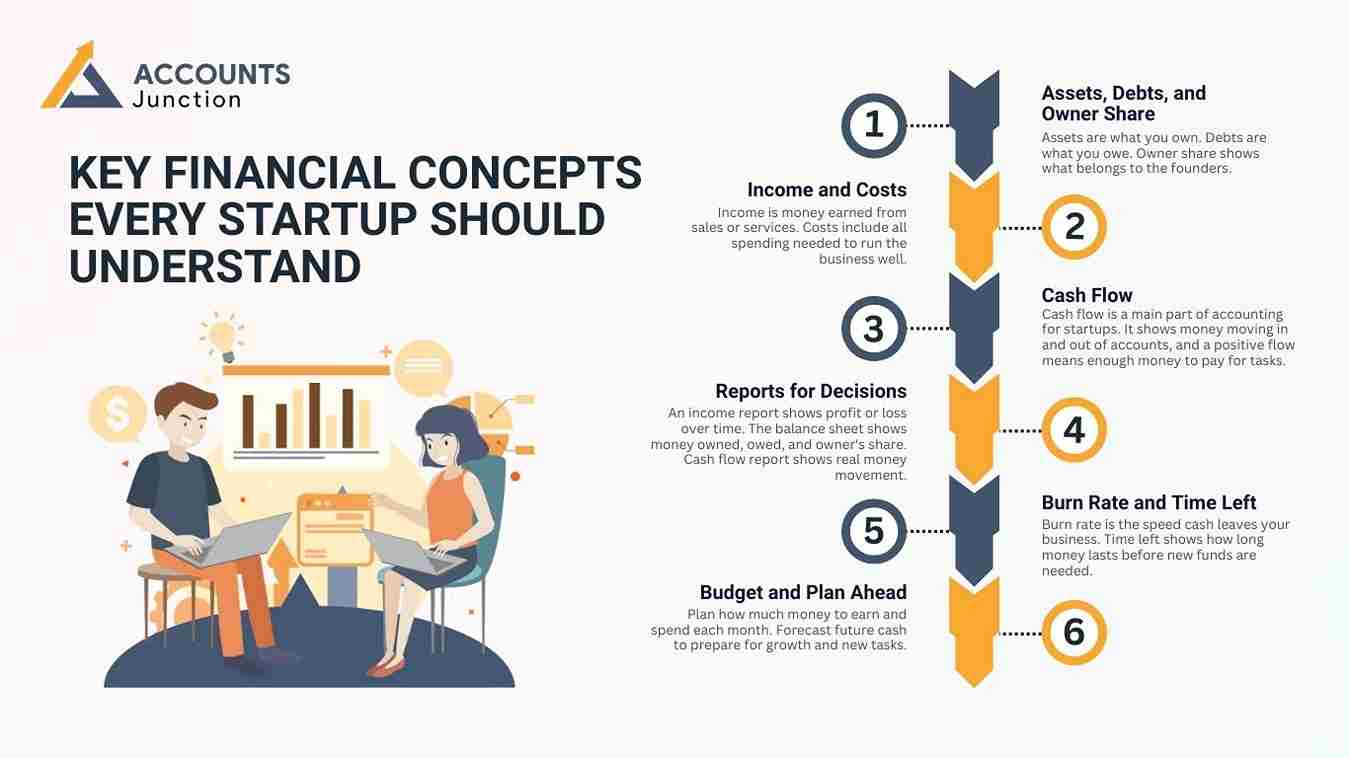

Key Financial Concepts Every Startup Should Understand

-

Assets, Debts, and Owner Share

Assets are what you own. Debts are what you owe. Owner share shows what belongs to the founders.

-

Income and Costs

Income is money earned from sales or services. Costs include all spending needed to run the business well.

-

Cash Flow

Cash flow is a main part of accounting for startups. It shows money moving in and out of accounts, and a positive flow means enough money to pay for tasks.

-

Reports for Decisions

An income report shows profit or loss over time. The balance sheet shows money owned, owed, and owner's share. Cash flow report shows real money movement.

-

Burn Rate and Time Left

Burn rate is the speed cash leaves your business. Time left shows how long money lasts before new funds are needed.

-

Budget and Plan Ahead

Plan how much money to earn and spend each month. Forecast future cash to prepare for growth and new tasks.

Common Bookkeeping Challenges

-

Late Records

Waiting to enter transactions creates mistakes and wrong reports. Timely records help see issues and fix them fast.

-

Mixing Money

Mixing personal and business money leads to errors and confusion. Keep accounts separate to avoid problems.

-

Wrong Method or Tool

Using the wrong method gives a false picture of money. Poor tools can slow growth and create stress.

-

Wrong Categories

Wrongly labeled income or costs make reports useless. Consistent labeling keeps decisions and taxes accurate.

-

Ignoring Rules

Not paying attention to taxes or legal rules is risky. Planning payments and filings avoids fines and trouble.

Best Practices in 2026

Use Cloud Software

- Cloud tools let teams see money data anytime. It improves teamwork and protects records from loss.

Automate Routine Work

- Automation is a smart step in accounting for startups. Auto-tracking invoices, bills, and payments saves time and lets founders focus on core work.

Watch Key Numbers

- In accounting for startups, track cash flow, burn rate, and profit regularly. These metrics show areas to cut costs or spend more.

Make Funders-Ready Reports

- Clear statements show your business is reliable and strong. They make loan and funding talks simple.

Plan Taxes

- Organize payments and files early to avoid stress. Consistent planning keeps the business safe from fines.

Prepare for Growth

- Choose software and steps that handle more transactions. This ensures smooth scaling without errors or delay.

Hire Experts

- Skilled bookkeepers or accountants reduce mistakes and save time. They provide insights for smart financial choices.

Set Checks

- Approval steps and reviews prevent errors or fraud. Regular checks keep reports accurate and trustworthy.

Use Money Data

- Study spending, income, and profits to improve choices. Data helps decide what to invest in next.

Review Often

- Check processes regularly to fix mistakes and improve work. Adjust steps as the business grows and changes.

Growing Bookkeeping With Your Startup

- Move from sheets to full software as work grows.

- Reconcile accounts monthly to ensure all money is tracked.

- Forecast for different cases to plan for cash gaps. These steps are part of advanced accounting for startups.

- In accounting for startups, add multi-currency support or new rules for global expansion.

- Keep records ready for funders or legal review.

Modern Accounting Trends for Startups in 2026

Startup accounting is changing fast. With new tech and tighter rules, accounting is now a key part of smart business growth, not just number tracking.

Below are the main trends shaping accounting for startups in 2026.

1. Tech Leading the Change

- Use of Automation and AI: Startups now use tools that match records, sort data, and process books with less effort.

- Live Dashboards: Cloud apps show real-time cash flow and key numbers, helping founders act fast.

- Fewer Errors: Digital tools cut manual mistakes and raise accuracy.

2. Accounting as a Growth Partner

- Beyond Basic Books: Accountants now help plan growth, manage funds, and guide funding plans.

- Data-Based Choices: Reports help set prices, control costs, and plan for scale.

- Team Planning: Finance teams and founders work together to forecast and prepare for new funds.

3. Smart and Predictive Insights

- Cash Flow Alerts: New tools can predict cash needs and spot risks before they grow.

- Track Key Metrics: Startups track burn rate, profit, and customer cost to stay on goal.

- Plan Ahead: Data helps find ways to save and areas to grow.

4. Rules and Investor Needs

- Tight Rules: New laws need clear and up-to-date records for full trust.

- Investor Ready: Clean, quick reports build trust and help raise funds.

- ESG Focus: Firms now show how they meet social and green goals.

5. Growth Through Innovation

- Early Tech Use: Startups that use tech early cut risk and make smart money moves.

- Accounting for Growth: Modern accounting helps scale and plan, not just meet rules.

- Stay Ahead: Using smart tools gives startups a clear edge.

Bookkeeping is a key part of startup growth in 2026. Clear records help track money, guide decisions, and reduce risk. Good bookkeeping also builds trust with funders and shows that the business is organized.

Accounts Junction helps startups handle bookkeeping, taxes, and reports with ease. Our experts simplify processes and save founders valuable time. We provide tools and guidance to keep records accurate. Partnering with Meru Accounting ensures startups stay compliant, reduce errors, and plan for future growth.

FAQs

1. What does bookkeeping mean for startups?

- Bookkeeping means keeping full money records for a startup. It helps track cash, plan costs, and note growth.

2. Why should startups in 2026 focus on bookkeeping?

- Strong money records can help startups plan, grow, and gain funder trust.

3. How is startup bookkeeping different from normal accounting?

- Startup bookkeeping tracks fast cash flow, while normal accounting is slower and more fixed.

4. When should a new startup start bookkeeping?

- Bookkeeping should start at launch to keep all cash data clear.

5. What bookkeeping method is best for startups, cash or accrual?

- Small firms may use cash first, then shift to accrual as they grow.

6. How can bookkeeping help in fundraising?

- Good books show funders your cash use and help gain their trust.

7. What is a chart of accounts in startup bookkeeping?

- It is a list of income, spend, assets, and dues used to track money.

8. How often should a startup review its books?

- Books should be checked each week or month to stay up to date.

9. What are the top bookkeeping challenges for startups?

- Mixing funds, missed notes, and unclear spend can cause report issues.

10. How can auto tools improve startup bookkeeping in 2026?

- Auto tools sort and save money data fast, cutting errors and saving time.

11. What money reports should every startup track?

- Each startup should track income, spend, and cash flow in its reports.

12. What is burn rate, and why does it matter?

- Burn rate shows how fast your cash drops each month before profit.

13. How does bookkeeping help in tax filing?

- Clean records make tax filing smooth and help save time and money.

14. Can startups handle bookkeeping in-house?

- Yes, but it takes time. Many founders hire experts for better work.

15. Why is it key to split personal and firm funds?

- It keeps money data clear, avoids tax mix-ups, and builds trust.

16. How can startups pick the right bookkeeping tool?

- Choose tools that fit your team size, goals, and future plans.

17. What trends may shape startup bookkeeping in 2026?

- AI tools, live dashboards, and cloud links may lead the trend.

18. How can bookkeeping data guide better plans?

- Money data shows where to save and where to grow the startup.

19. What is funder-ready bookkeeping?

- It means your books stay clean, checked, and ready for funder review.