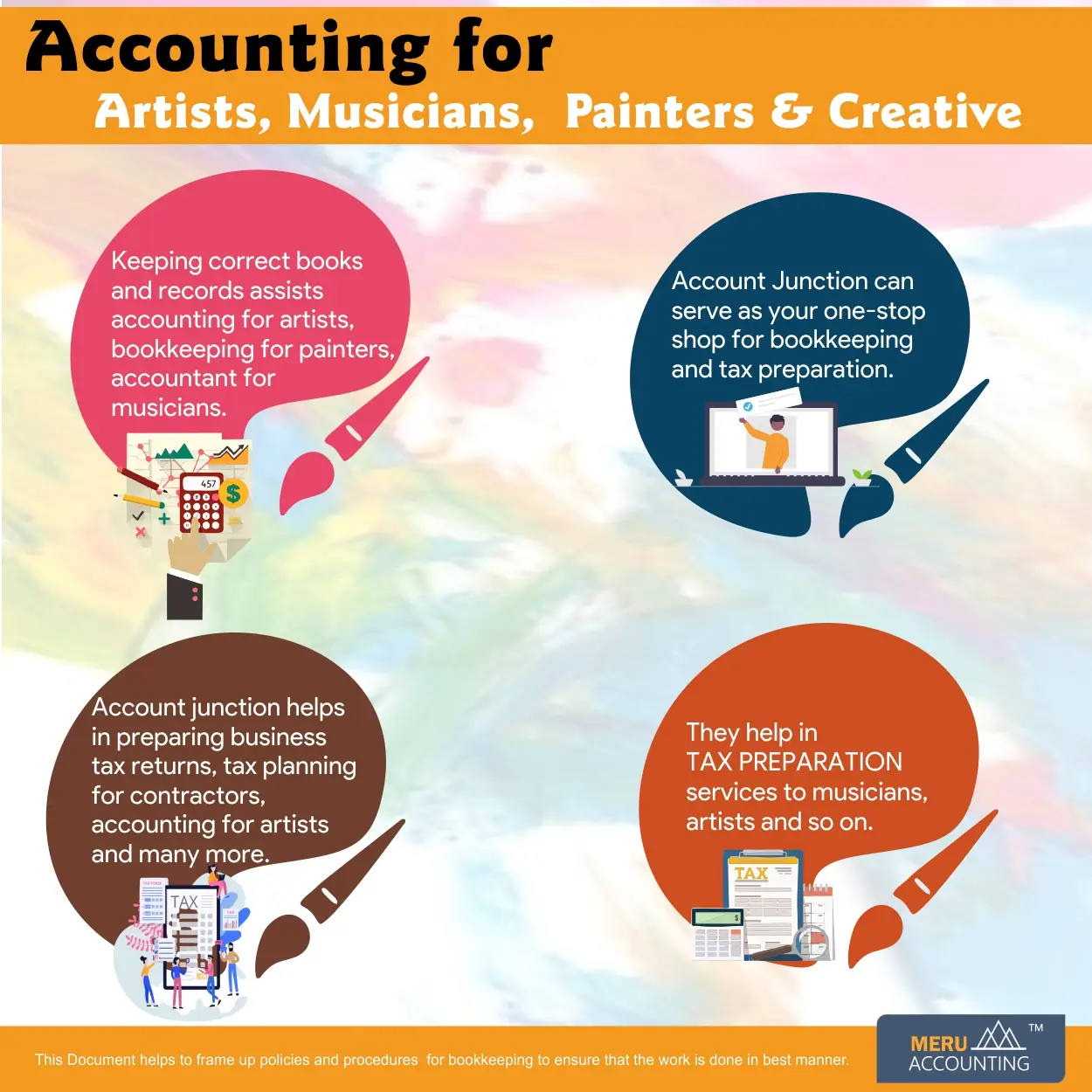

Bookkeeping and Accounting for Artists, Painters, and Musicians

Tax Planning and Preparation Services for Artists:

Basics of Bookkeeping and Accounting for Artists and Painters:

1. Bookkeeping:

- Keeping track of income and expenses to create a record of financial transactions, including invoices, receipts, and payment records.

2. Accounting

- Analysing bookkeeping records to gain insights into the financial health of your artistic practice, involving tasks such as reconciling bank statements, preparing financial statements, and calculating taxes owed.

3. Tools and Software:

- Utilize accounting software tailored for artists and painters to automate bookkeeping tasks and generate customized reports for better financial management.

4. Key Terms:

- Familiarize yourself with important bookkeeping terms such as revenue (income), expenses (costs), assets (owned items), and liabilities (debts or obligations) to understand financial discussions.

5. Benefits:

- Accurate record-keeping enables you to assess your business's profitability, identify areas for cost reduction or revenue growth, and make informed decisions about pricing and investments.

6. Time for Art:

- Embracing bookkeeping and accounting basics empowers you to confidently take control of your finances, freeing up more time for your true passion – creating beautiful art.

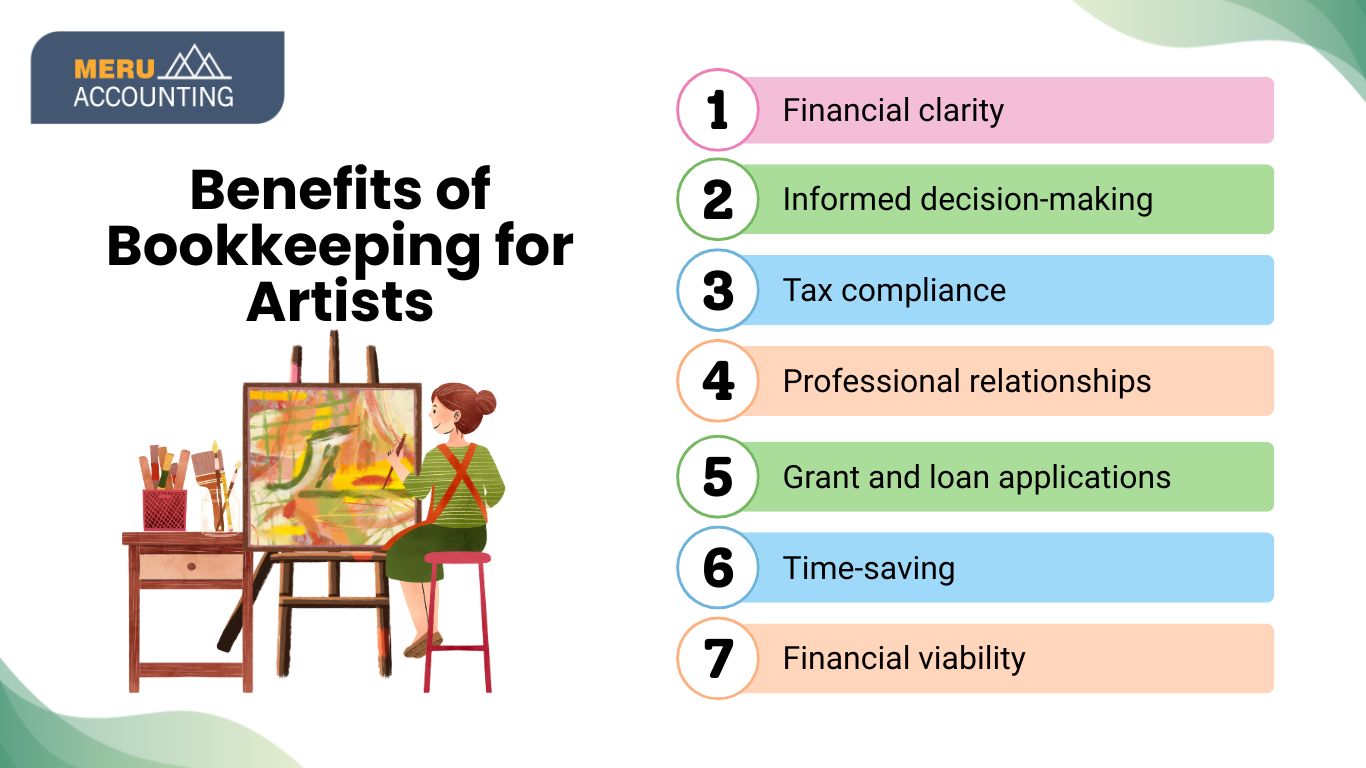

Benefits of Bookkeeping for Artists:

1. Financial clarity:

- Bookkeeping provides artists with a clear picture of their financial situation, including income and expenses.

2. Informed decision-making:

- Understanding your finances allows you to make informed decisions about pricing, budgeting, and investing in your artistic career.

3. Tax compliance:

- Proper bookkeeping ensures accurate reporting of income and identifies deductible expenses, reducing tax liabilities and helping artists stay on top of tax obligations.

4. Professional relationships:

- Keeping track of receipts and invoices through bookkeeping enables prompt and accurate invoicing, maintaining professional relationships with clients and galleries.

5. Grant and loan applications:

- Well-maintained financial records facilitate the application process for grants or loans, as funding organizations often require detailed financial statements.

6. Time-saving:

- Outsourcing or offshore bookkeeping services free up artists' time, allowing them to focus on creating art and pursuing new opportunities.

7. Financial viability:

- Good bookkeeping practices demonstrate the financial viability and professionalism of an artist's endeavors, increasing credibility and opportunities for growth.

Bookkeeping is an essential aspect of managing the financial side of an artistic career, and artists can benefit from working with an accounting firm like Accounts Junction. We specialize in providing comprehensive financial services tailored to the unique needs of artists, painters, and musicians. With our expertise in artist-specific financial management, Accounts Junction can offer valuable insights and guidance. We can handle bookkeeping tasks, ensuring accurate record-keeping and compliance with accounting standards. Moreover, we can provide tax planning and optimization services, helping artists navigate the complexities of tax regulations and identify deductions and credits specific to their artistic careers. Additionally, Accounts Junction can offer financial guidance and planning, assisting artists in developing budgets, setting financial goals, and analyzing their financial performance. By partnering with Accounts Junction, artists can focus more on their creative work while ensuring the long-term financial success of their careers.

| # | Account Number | Account Name | Account Type |

|---|---|---|---|

| 1 | 1010 | : Cash on Hand | Assets: Curent Assets |

| 2 | 1020 | : Cash in Bank (Operating Account) | Assets: Curent Assets |

| 3 | 1030 | : Accounts Receivable (Customer Invoices for art sales or commissions) | Assets: Curent Assets |

| 4 | 1040 | : Inventory (Art Supplies, Finished Artworks, Framing) | Assets: Curent Assets |

| 5 | 1050 | : Prepaid Expenses (E.g., insurance, studio rent paid in advance) | Assets: Curent Assets |