Australia Tax on Foreign Income

Money can move around the world, but taxes also follow it. If you earn money from outside Australia, a question comes up: how much do you need to tell Australia, and how does it tax that money? The concept of Australia Tax on Foreign Income can sound tricky, but it becomes much easier once you break it down.

This blog will explain how Australia treats foreign income. It will show what residents and nonresidents should know. It will also help you understand how to report foreign income on your ATO tax return. By the end, you will have a clear idea without feeling confused.

What Is Foreign Income?

Foreign income comes in many forms. It includes salary from overseas work, rental income from a property abroad, interest from a foreign bank, or dividends from an international company.

Simply put, any money earned outside Australia counts as foreign income.

The key question is: does Australia tax it? The answer depends on one important factor: your residency status for tax purposes. Reporting foreign income correctly on your ATO tax return helps avoid issues later.

Residency and Its Role

Why Residency Matters

In Australia, tax rules depend not only on where you live but on how the Australian Taxation Office (ATO) classifies you.

If the ATO considers you a resident for tax purposes, you need to declare all worldwide income, including earnings made overseas, on your ATO tax return. Nonresidents, on the other hand, are only taxed on income earned within Australia. It sounds simple, but sometimes it is not. Let’s explore how residency is determined.

How Residency Is Determined

The ATO uses several tests to decide if someone is a resident for tax purposes:

Resides Test: Checks if you actually live in Australia and consider it your home.

Domicile Test: Looks at your permanent home; unless it is outside Australia, you may be treated as a resident.

183 Day Test: Spending more than half the year in Australia often qualifies as residency.

Commonwealth Superannuation Test: A strong and consistent cash flow builds credibility with lenders and investors. This makes it easier to secure loans and attract investment for future growth.

Reduces Financial Risks: Applies to certain government employees working abroad.

Some people meet more than one test, or their status can change over time. Knowing which test applies ensures your ATO tax return is accurate.

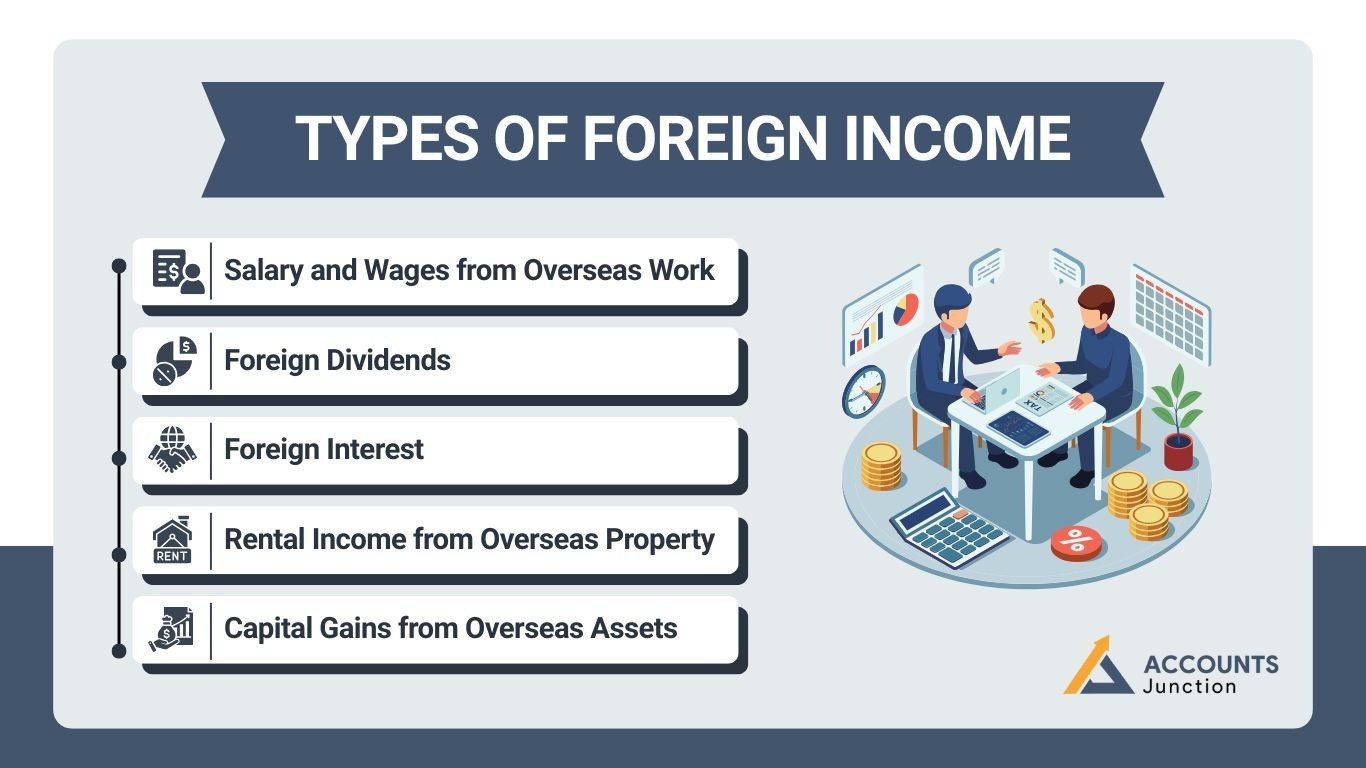

Types of Foreign Income

Foreign income can appear in many forms. Here are common types the ATO considers and how to report them on your ATO tax return.

1. Salary and Wages from Overseas Work

Even if you work abroad, Australia often expects residents to declare that income. Taxes might have been paid overseas, but Australia usually requires reporting as well. Fortunately, a foreign income tax offset can reduce the risk of being taxed twice. Listing this correctly on your ATO tax return keeps things clear.

2. Foreign Dividends

Dividends from international companies are considered foreign income. Some dividends come with withholding taxes or foreign tax credits. Declaring them on the ATO tax return ensures offsets are claimed properly.

3. Foreign Interest

Interest earned from foreign bank accounts counts as income. Even small amounts should be included. This includes joint accounts, online accounts, and reinvested interest. Properly reporting these on your ATO tax return avoids mistakes.

4. Rental Income from Overseas Property

If you own property overseas and rent it out, the rent is often taxable in Australia. Expenses like repairs, management fees, and loan interest can be claimed as deductions. Keeping detailed records makes reporting easier on your ATO tax return.

5. Capital Gains from Overseas Assets

Selling overseas assets, such as property or shares, can create capital gains. Australian residents usually need to declare them, though taxes paid abroad might reduce the amount taxed locally. Accurate calculation for your ATO tax return helps avoid surprises.

How Foreign Income Is Reported on ATO Tax Return

Reporting foreign income does not need to be complicated.

Convert to Australian Dollars: Use the exchange rate at the time of income.

Declare in the Tax Return: Include all foreign income in the foreign income section of your ATO tax return.

Claim Foreign Tax Offsets: Credit any tax paid overseas to reduce double taxation.

Keep Records: Payslips, tax certificates, and bank statements support your claims.

Providing accurate information on your ATO tax return reduces the chance of audits or penalties.

Double Taxation and Tax Treaties

What Is Double Taxation?

Double taxation happens when two countries tax the same income.

For example, earning in India while living in Australia could lead to both countries taxing that income.

Tax treaties help prevent this. Declaring foreign income correctly on your ATO tax return allows you to claim offsets under treaty rules.

Australia’s Tax Treaties

Australia has tax treaties with many countries to reduce double taxation. These treaties usually state which country has the primary right to tax certain income. Sometimes, the source country taxes first, and Australia provides a credit. Other times, only one country taxes it. Checking for treaties with your income source helps keep your ATO tax return accurate and compliant.

Foreign Income Tax Offset

What It Means

The foreign income tax offset is a relief mechanism. If you paid foreign tax on income that is also taxable in Australia, you can claim a credit.

This avoids paying tax twice. The offset depends on the amount of foreign tax and what part is taxable locally. Small amounts, currently under one thousand dollars, can often be fully claimed on your ATO tax return without complex calculations.

Common Mistakes to Avoid for Australia Tax on Foreign Income

1. Forgetting to Include Foreign Income

Income earned overseas is rarely invisible to the ATO. Global information sharing means foreign accounts and investments are often already known. Reporting all income on your ATO tax return avoids penalties.

2. Not Converting Correctly

Income should be converted using the correct exchange rate. Incorrect rates can cause errors and complications on your ATO tax return.

3. Ignoring Small Amounts

Even minor interest or dividends must be included. The ATO can detect unreported amounts through global data sources.

4. Missing Deductions

Expenses tied to foreign income, such as property costs or management fees, can reduce taxable income.

Properly noting them on your ATO tax return maximizes benefits.

5. Misunderstanding Residency

Short trips abroad do not always change your tax residency.

Understanding the difference between temporary travel and permanent relocation ensures your ATO tax return is correct.

Foreign Income for Temporary Residents

Temporary residents in Australia enjoy certain exemptions. Most foreign income is not taxed unless linked to Australian jobs or investments. Rules are detailed, so temporary residents should check how they affect their ATO tax return.

Record Keeping and Documentation

Good records save time and trouble.

Keep copies of:

- Payslips and tax documents

- Bank statements showing interest

- Property rental records

- Proof of foreign taxes paid

Maintaining records for five years supports your ATO tax return if questioned.

Dealing with the ATO

Reaching out early to the ATO or a registered tax agent helps clarify forms, reporting, and offsets on your ATO tax return. Delays or omissions can lead to penalties or audits.

Foreign Income and Superannuation

Earnings moved into Australian superannuation funds may be taxable. Understanding these rules ensures transfers are correctly reported on your ATO tax return.

Technology and Global Reporting

Data sharing makes the world more transparent. The Common Reporting Standard allows foreign banks to report income to the ATO automatically. Proper reporting on your ATO tax return ensures compliance and peace of mind.

When You Move Abroad

Leaving Australia can change your tax status. Becoming a nonresident stops most Australian tax on foreign income but may trigger taxes on existing assets, called deemed disposal. Planning this carefully keeps your ATO tax return accurate.

Breaking down the Australia Tax on Foreign Income reveals the essentials: residency, accurate reporting, and tax offsets. Clear records can protect you in all these situations. The ATO enforces rules but allows fair relief where double taxation occurs. Being prepared simplifies your ATO tax return and avoids surprises.

If you want someone to manage ATO tax return for you, outsource it to Accounts Junction. Our Australian tax return services can help you whether you are an Australian resident or not. Contact us now to know more about our ATO tax return services.